Nabeel Bin Muhammed, an entrepreneur born in India, raised in the Middle East, and now shaping the financial technology landscape in the UK, is on a mission to drive financial wellness. At the core of his work lies a deep commitment to tackling the pressing issue of financial insecurity—where millions of UK households struggle to build savings or maintain financial stability. With innovative thinking and a determination to create lasting impact, Nabeel is reshaping how individuals and businesses approach financial health.

The Urgent Need for Financial Wellness

In the UK, a large proportion of adults face financial vulnerability, with little to no savings to buffer unexpected challenges. Recognizing this, Nabeel has focused his entrepreneurial journey on empowering people to take control of their finances. His mission: to make financial wellness accessible, practical, and sustainable.

Nabeel’s career journey began as a KYC Analyst at HSBC in India, where he gained expertise in problem-solving and compliance. He went on to co-found tech startups like Quzyn and Appsys, with Quzyn earning a nomination for the prestigious India 500 Startup Awards 2020. These early experiences shaped his understanding of technology-driven solutions and laid the foundation for his vision.

When Nabeel moved to the UK in 2021 to pursue an MBA at the University of Essex—where he graduated with first-class honors and received the esteemed Dean’s Excellence Award Scholarship—he encountered the financial challenges faced by UK households and SMEs. This exposure inspired him to develop innovative solutions to address these systemic issues.

From Vision to Action: Building Solutions that Drive Change

Nabeel honed his leadership and operational expertise as Deputy Operations Manager at Amazon UK, where he spearheaded change initiatives, delivering a 30% boost in productivity and enhancing customer satisfaction. His success managing large-scale, multimillion-pound projects solidified his ability to transform ambitious ideas into tangible results.

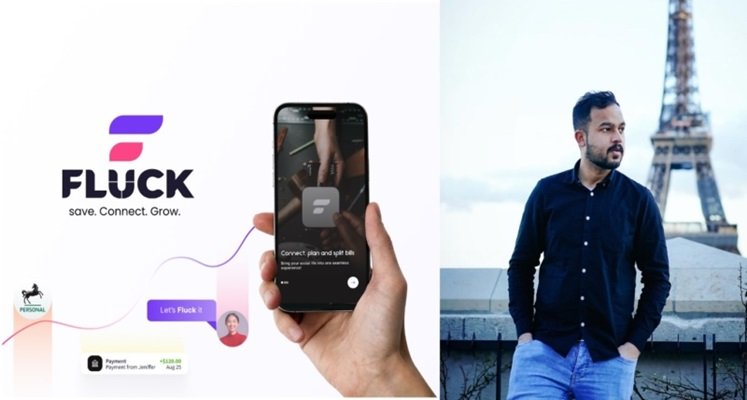

These experiences culminated in the development of Fluck, a fintech super app launching in 2025, designed to revolutionize financial wellness. With its innovative use of AI, open banking, and data-driven insights, Fluck aims to transform how individuals and businesses manage their money.

Fluck: A Game-Changer for Financial Health

Empowering Individuals to Save Smarter

Fluck tackles the root causes of poor saving habits by leveraging AI-powered tools to help users:

- Automate Savings: Analyze spending patterns and automate small, frequent transfers to savings accounts.

- Set Financial Milestones: Create and track progress toward financial goals, whether for emergencies or big life events.

- Earn Rewards: Encourage savings with cashback incentives and loyalty rewards.

“Saving isn’t about willpower alone—it’s about building systems that make it intuitive and rewarding,” Nabeel explains. “Fluck helps people turn saving into a seamless habit.”

Enabling SMEs to Thrive

For small businesses, Fluck offers a suite of tools to enhance cash flow and efficiency:

- Customer Insights: Understand spending patterns to craft personalized offers and improve loyalty.

- Lower Transaction Fees: Leverage open banking for cost-effective payment processing.

- Target Local Audiences: Use geolocation and data-driven marketing to connect with nearby customers.

“Fluck isn’t just an app—it’s an ecosystem where individuals and businesses grow together,” says Nabeel. “By fostering transparency and trust, we’re building financial systems that work for everyone.”

Extending Impact: Bridging the Skills Gap with Vazgro

Beyond financial wellness, Nabeel is addressing another critical challenge: the growing skills gap in the UK job market. His co-founded venture, Vazgro, uses AI to:

- Assess job seekers’ skill gaps.

- Recommend tailored training programs.

- Connect users with career opportunities aligned to their goals.

This dual focus on financial and professional empowerment underscores Nabeel’s holistic approach to solving systemic challenges.

Championing Innovation and Mentorship

Nabeel’s impact extends beyond his ventures. A thought leader in AI, product innovation, and digital transformation, he has shared insights at prestigious platforms like the White Label World Expo and served as a judge for innovation awards. Through his work with MentorTogether, he actively supports aspiring entrepreneurs, offering guidance on ideation, product development, and scaling businesses.

“Mentorship isn’t just about advice—it’s about equipping others to create their own success stories,” Nabeel emphasizes.

A Vision for Lasting Impact

At the heart of Nabeel’s work is a belief that technology should solve real-world problems. From helping individuals build financial resilience to empowering businesses and professionals, his mission is rooted in delivering meaningful change.

“The challenges around financial wellness and employability are significant, but they’re solvable,” Nabeel concludes. “With the right tools, technology, and mindset, we can turn financial insecurity into financial empowerment.”

As he prepares to launch Fluck and expand Vazgro, Nabeel Bin Muhammed’s journey is a testament to the power of purpose-driven innovation. His vision promises a brighter, more secure future for individuals, businesses, and communities alike.

Continue reading